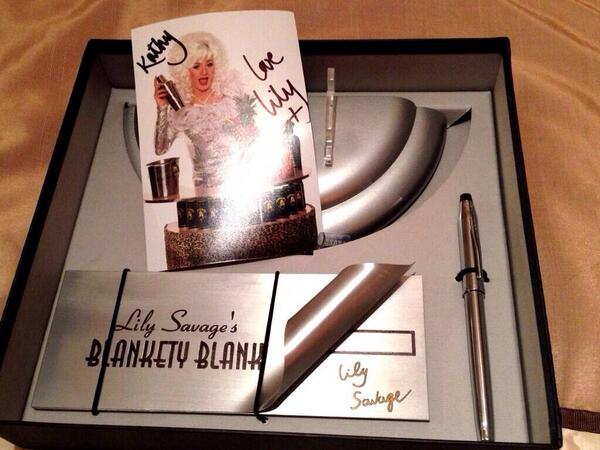

Host Bradley Walsh reading out statements with a missing word to guess. A panel of showbiz personalities trying to help a member of the public win cheapskate prizes. The ‘Blankety Blank Cheque book and pen’ were as much part of that show as Terry Wogan’s fancy microphone.An infuriatingly catchy theme tune. I am very hopeful that the producers and Mr Walsh recognise the continued significance of the humble cheque, its history and how robust it remains. They wish to make and accept cheque or in fact cash. People should be allowed the choice to continue to make their own decision if Under the Bills of Exchange Act, it is still a means of payment used by many. It continues to be more than a ‘prop’ for popular game shows. Instead, they can image in real time thus maximising treasury Whether they are making refunds, paying dividends or paying suppliers, this service reduces administration and drives efficiencies but still uses the ‘good old dependable’ cheque as theĪs banks continue to close branches on the high street, the introduction of remote deposit capture solutions (RDC) negates the need for Corporate and business customers to take cheques to the bank. Remotely make payments using TALL Group as a bureau and hosting service. The TALL Send-A Cheque™ service, for instance, allows businesses large and small to Through the COVID-19 Pandemic when people were working remotely, TALL have been hard at work developing new and highly successful payment options to support our customers. Is a fraction of that of other payment instruments at just 1% and is in fact reducing due to the introduction of bank-recommended image survivable security features (ISFs) on cheques.

Recent statistics (Fraud the Facts 2020) show that cheque fraud as a percentage TALL have also developed the innovative patented security algorithms that are securing the next generation cheque that is being imaged through the banking systems in the UK today. The suspense, the jeopardy of physically holding a cheque for a substantial amountĪnd potentially losing it was replaced to appear more updated, but not sure it worked particularly for older viewers.Ī lesser-known fact is that DLRT’s sister company, TALL Security Print produced the cheques used in the original “Who wants to be a Millionaire” hosted by Chris Tarrant, and many of those Big cheques that continue to be presented today. Wants to be a millionaire” hosted by Jeremy Clarkson, I believe was the lesser for it when they decided not to present a cheque, an act ‘mocked’ by Clarkson in the first episode.

#Blankety blank chequebook tv

Indeed, the return of the TV quiz show “Who When we raise money for charitable causes, we present a BIG cheque. Sometimes an alternative, or even a back-up, is a good thing particularly as we see increasing levels of cybercrime, hacking andīack in 2017, the footballer Neymar was bought by the football club Paris St Germain (PSG) using a rather large cheque payment for €222 million. The tangible transaction, the physical action of making a payment by cheque or cash still has its place. We will be the lesser for it as we remove physical methods Over the last few years as newer payment methods become more prevalent, the place of the cheque has been somewhat side-lined as a legacy or old technology much the same as is happening now with cash. Introduction of Image Clearing back in 2017 in the UK breathed new life into the cheque allowing a reduction in the payment cycle to two days using an image of the cheques rather than the paper document to transfer payments via mobile phone or via desktop In 2020, volumes of the ‘good old dependable’ cheque were still in excess of 188m. It continues to be simple and easy to use. Using cheques whether they are small businesses, charities or individuals making ad hoc payments. It has been a staple of worldwide payments since this time, being accepted as a mainstay of business transactions. The cheque though as a payment instrument dates back to the 1600’s in the UK and even further back in Italy. Now, as we progress through 2021 new digital and online technologies are slowly replacing the humble paper cheque. In 1990, over £3bn cheques were written annually. This was the heyday of cheques as a payment instrument in the UK. Originally a firm family favourite on the BBC back in the 1980’s under fellow Irishman, Sir Terry Wogan and again reprised under the always funny Les Dawson, the premise of the game was a fun quiz where a prize was a “Blankety Blank cheque book and pen”.Īs a family we sat and enjoyed it together, grandparents, parents, my siblings and I.

The recent news that the iconic ‘Blankety Blank’ game show was returning to our screens under the masterful Bradley Walsh brought back many great memories.

0 kommentar(er)

0 kommentar(er)